What forex traders should actually know about MetaTrader 4

What keeps MT4 relevant after two decades

MetaQuotes stopped issuing new MT4 licences some time ago, steering brokers toward MT5. Yet most retail forex traders kept using MT4. The reason is not complicated: MT4 does one thing well. A huge library of custom indicators, Expert Advisors, and community scripts run on MT4. Switching to MT5 means rebuilding that entire library, and the majority of users would rather keep trading than recoding.

I spent time testing MT4 and MT5 side by side, and the gap is smaller than you'd expect. MT5 adds a few extras like more timeframes and a built-in economic calendar, but the charting feels about the same. For most retail strategies, MT4 still holds its own.

MT4 setup: what the manual doesn't tell you

Installation takes a few minutes. The part that trips people up is getting everything configured correctly. On first launch, MT4 opens with four charts tiled across one window. Close all of them and start fresh with the instruments you follow.

Save yourself resources repeating the same setup by using templates. Build your usual indicators once, then save it as a template. From there you can load it onto other charts without redoing the work. Minor detail, but over weeks it adds up.

One setting worth changing: go to Tools > Options > Charts and check "Show ask line." MT4 only shows the bid price on the chart, which can make entries appear wrong until you realise the ask price is hidden.

MT4 strategy tester: honest expectations

MT4's built-in strategy tester lets you run Expert Advisors against historical data. But here's the thing: the quality of those results depends entirely on your tick data. The default history data is modelled, meaning it fills in missing ticks using algorithms. For anything that needs accuracy, download proper historical data.

The "modelling quality" percentage is more important than the headline profit number. Anything below 90% suggests the results aren't trustworthy. I've seen people show off backtests with 25% modelling quality and can't figure out why the EA fails in real conditions.

The strategy tester is one of MT4's stronger features, but only if you feed it decent data.

MT4 indicators beyond the defaults

MT4 ships with 30 default technical indicators. The average trader uses maybe a handful. But where MT4 gets interesting is in user-built indicators written in MQL4. The MQL5 marketplace alone has a massive library, spanning basic modifications to full trading dashboards.

The install process is painless: copy the .ex4 or .mq4 file into the MQL4/Indicators folder, reboot MT4, and you'll find it in the Navigator panel. The risk is quality. Community indicators vary wildly. A few are well coded and maintained. Some stopped working years ago and can freeze your terminal.

When adding third-party indicators, verify the last update date and if other traders report issues. A poorly written indicator won't just give wrong signals — it can freeze your entire platform.

Risk management settings most MT4 traders ignore

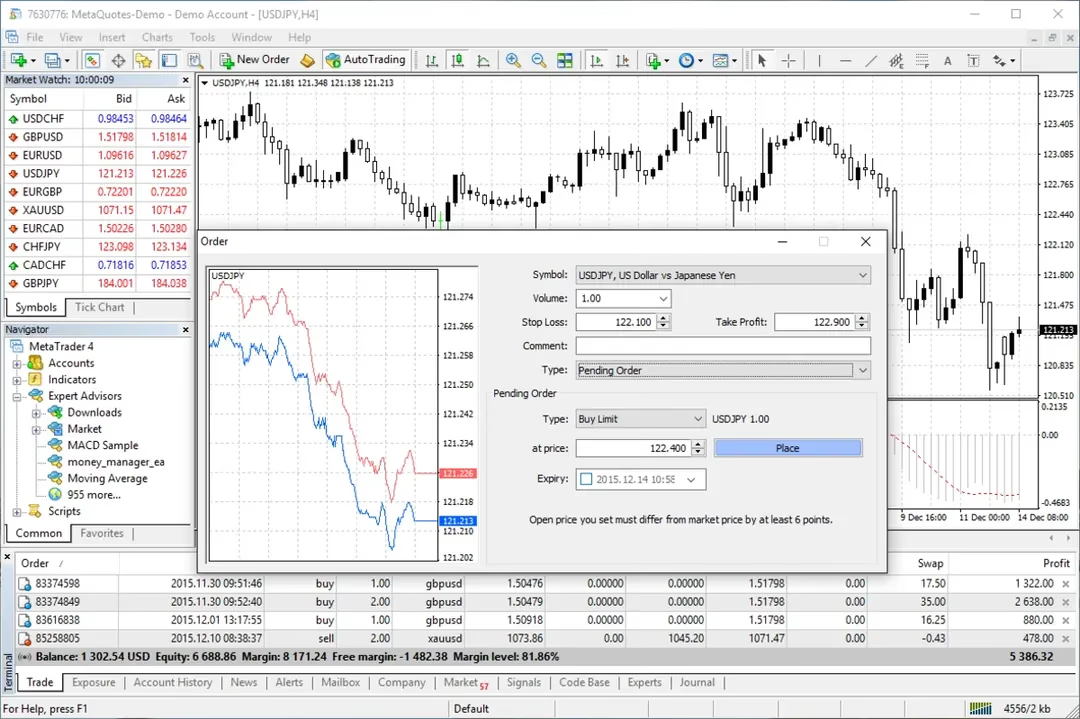

There are several built-in risk management features that a lot of people don't bother with. Probably the most practical one is the maximum deviation setting in the order window. This defines the amount of slippage is acceptable on market orders. Without this configured and the broker can fill you at whatever price the broker gives you.

Everyone knows about stop losses, but MT4's trailing stop feature are underused. Click on an open trade, choose Trailing Stop, and enter a distance. Your stop loss adjusts with price moves into profit. Doesn't work well in choppy markets, but on trending pairs it reduces the need to micromanage the trade.

These settings take a minute to configure and they take some of the guesswork out of trade management.

Expert Advisors — before you trust a robot with your money

Expert Advisors on MT4 have obvious appeal: program your strategy and stop staring at charts. In practice, a huge percentage of them underperform over any meaningful time period. EAs marketed using incredible historical results are usually fitted to past data — they performed well on past prices and fall apart the moment conditions shift.

This isn't to say all EAs are useless. Certain traders build custom EAs to handle one particular setup: time-based entries, managing position sizing, or closing trades at fixed levels. These utility-type EAs work because they do repetitive actions that don't require interpretation.

When looking at Expert Advisors, run them on a demo account for at least several weeks in different conditions. Running it forward in real time reveals more than backtesting alone.

MT4 on Mac and mobile: what actually works

MT4 is a Windows application at heart. Mac users deal with compromises. The traditional approach was emulation, which mostly worked but introduced display glitches and stability problems. A few brokers now offer native Mac apps built on Crossover or similar wrappers, which work more smoothly but still aren't true native apps.

On mobile, available for both Apple and Android devices, work well for watching your account and tweaking stops. Serious charting work on a mobile device isn't realistic, but adjusting a stop loss while away from your desk is worth having.

Check whether your broker offers real Mac support or a compatibility layer — the difference in stability is noticeable.